The Astonishing Pattern in Buffett's Past Sell-Offs! the Truth Behind the Unprecedented Massive Sell-Off Finally Revealed! Is a Major Crisis Imminent?

What Made Buffett Sell Stocks in Bulk? And What Led Him to Accumulate More Bonds than the Federal Reserve? What Did the Oracle of Omaha See? Is a Crisis Looming?

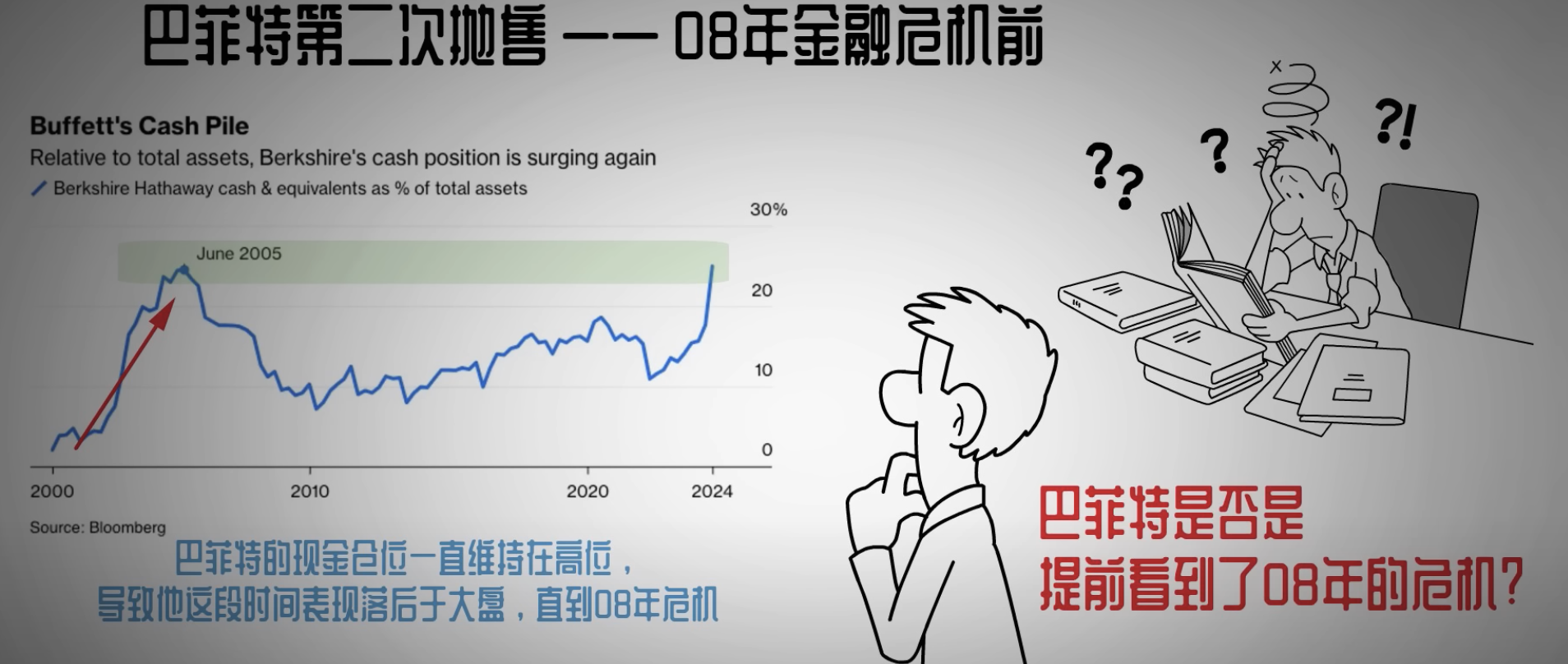

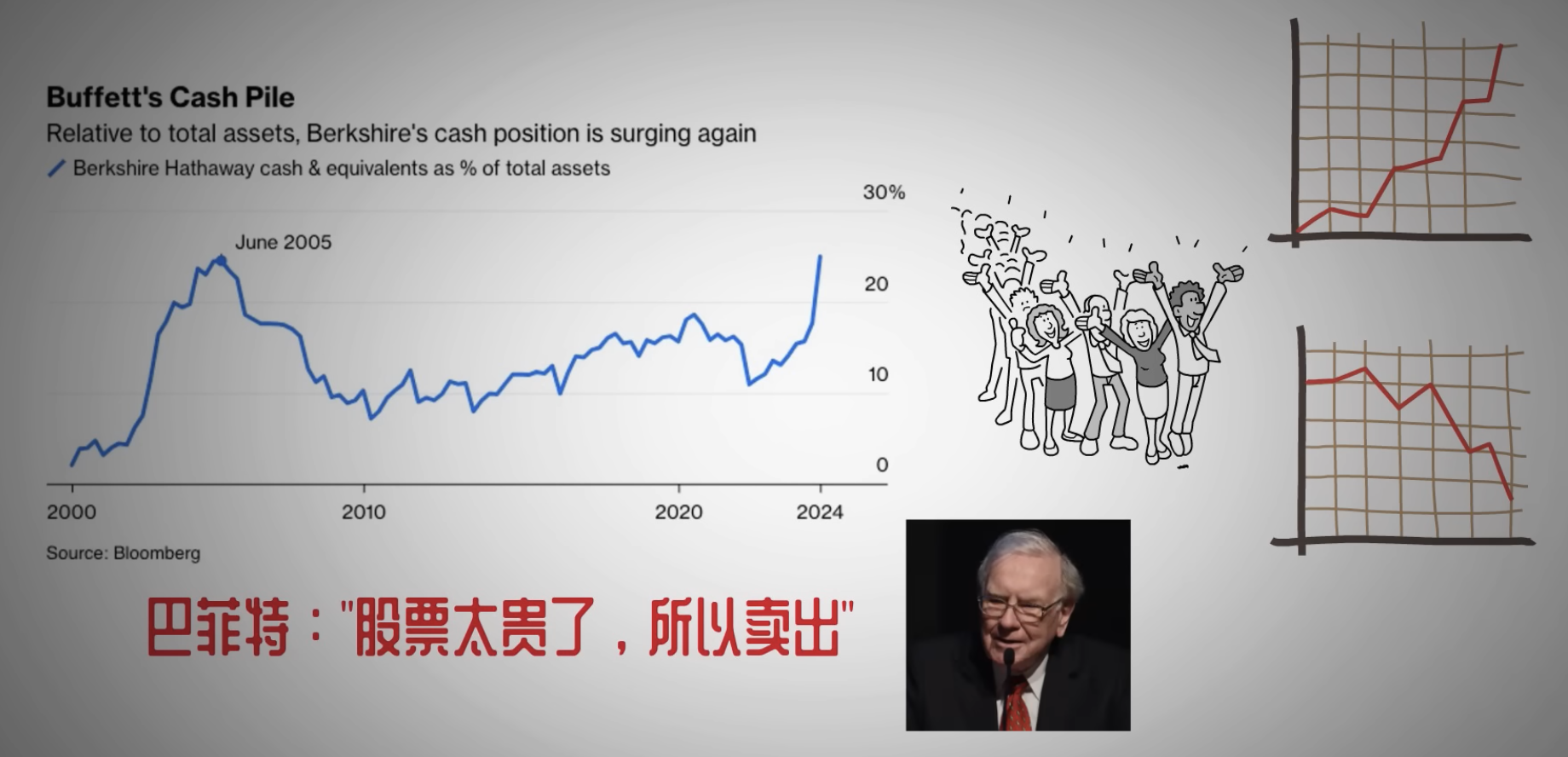

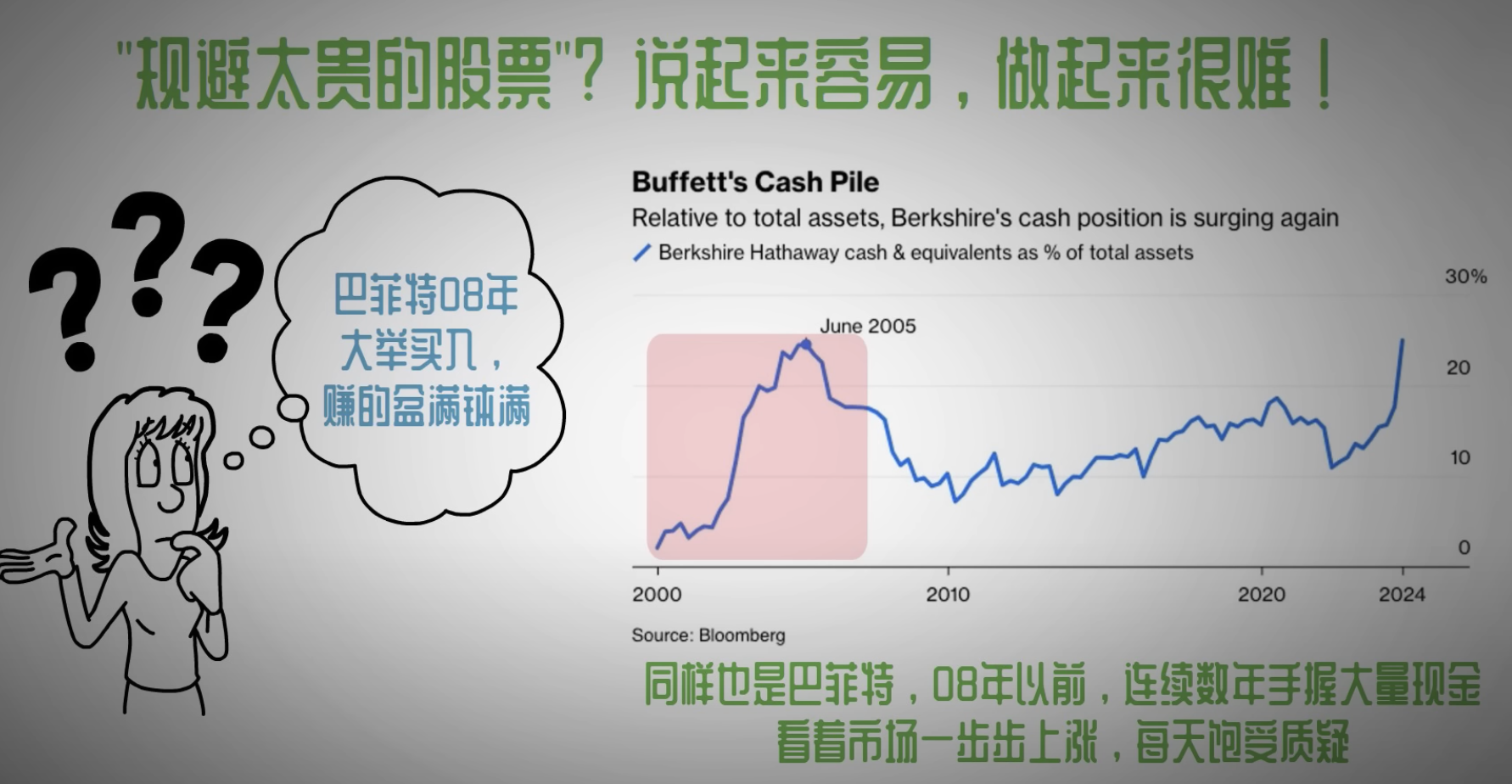

Recently, many have heard about Buffett’s massive stock sell-off. After selling his long-held shares in Bank of America, he also reduced his stake in Apple by more than half. Today, Buffett’s cash and cash equivalents have reached $227 billion, an unprecedented scale. The last time Buffett held such a high proportion of cash was in 2005, and shortly after, the largest financial crisis in a century hit the U.S.

So, is Buffett seeing some hidden danger this time? Should we follow Buffett’s lead and exit the market early?

To answer these questions, I specifically researched the historical context of Buffett’s first major stock sell-off and discovered a startling pattern that might explain the real reason behind Buffett’s current sell-off. In today’s video, let’s uncover the truth behind Buffett’s stock sales.

Throughout history, Buffett has had two very classic stock sell-offs: one in the early 1970s and another before the 2008 financial crisis. Both sell-offs are highly relevant to us today. The first and most representative sell-off happened in the early 1970s. Strictly speaking, this wasn’t just a sell-off but a liquidation. At that time, Buffett sold all of his stocks, almost retiring from investing. What exactly drove Buffett to make such a decisive move?

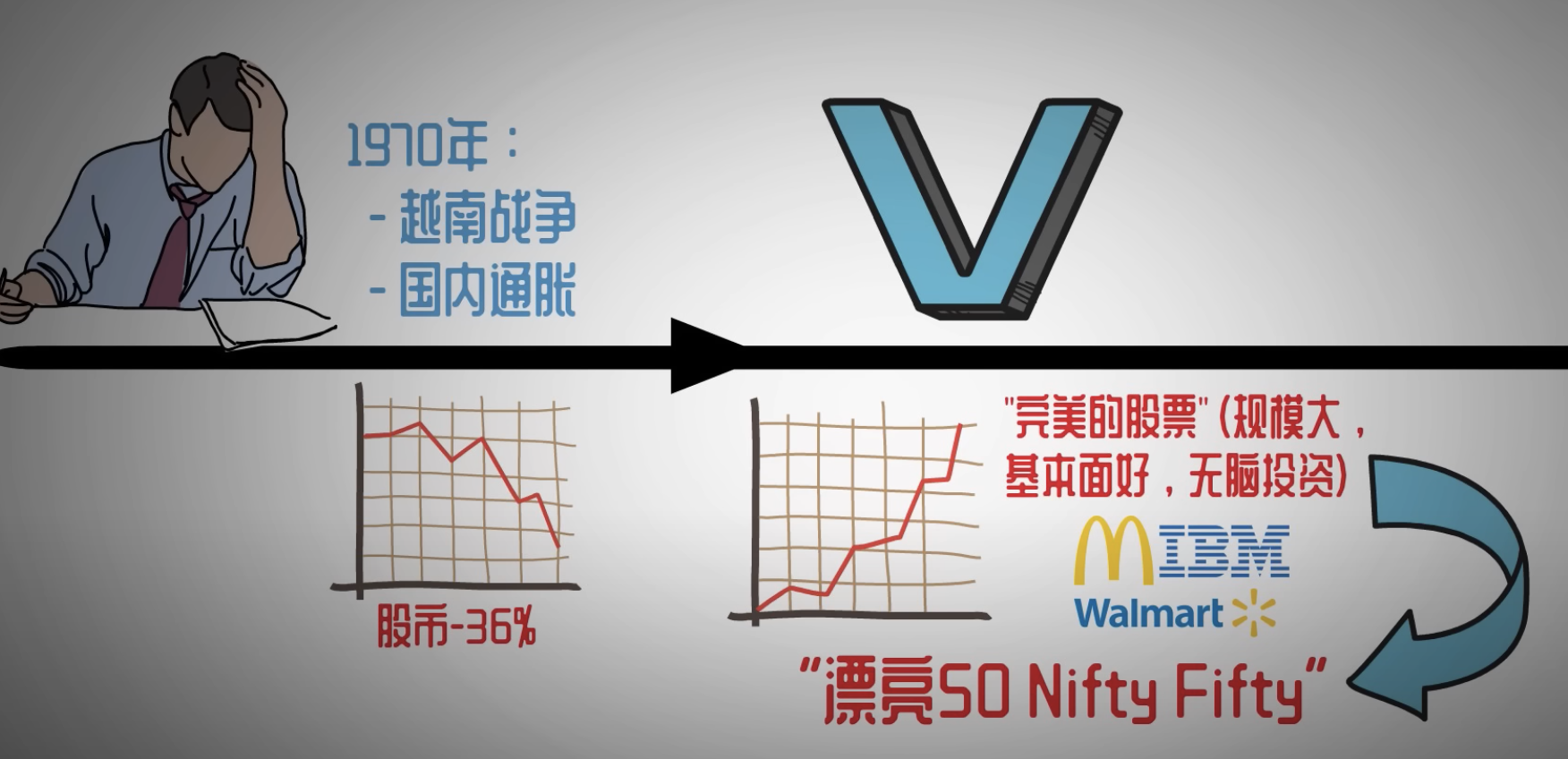

To understand this, we first need to look at the stock market background of the early 1970s. The four years from 1970 to 1973 were among the worst-performing years for the U.S. stock market post-World War II. During this short period, the stock market experienced two major bear markets. The first occurred in 1970, when the U.S. was mired in the Vietnam War and plagued by inflation. The combined effects of war and inflation led the U.S. economy into recession in 1970, with the stock market dropping 36%. Then a dramatic turn occurred: the stock market experienced a V-shaped recovery and reached new highs within the following two years.

During this time, a group of stocks emerged that were considered “perfect” and believed to never go wrong, including companies like McDonald’s, IBM, and Walmart. They were given a flattering name: the “Nifty Fifty.” Investors flocked to these stocks, and the market climbed steadily with the help of the Nifty Fifty. Does this story about the Nifty Fifty sound familiar? Indeed, it’s quite similar to today’s big tech stocks. I once did a video comparing the Nifty Fifty’s history to today’s big tech, which you can check out if interested.

By 1973, the first oil crisis hit, causing oil prices to quadruple in a short time. Coupled with the decoupling of the dollar and gold, this led to high domestic inflation in the U.S., making the situation uncontrollable. This crisis directly caused the stock market to drop 52%. Looking back, this was one of the most severe collapses post-WWII, second only to the 2008 financial crisis.

What was Buffett doing during these years? In fact, Buffett was completely absent from these two stock disasters. In the second half of 1969, Buffett had already sold all his stocks and even shut down his investment company, Buffett Partnership, leaving the stock market entirely. Even during the bull market of these two years, he remained inactive until the 1973 stock disaster ended, at which point the stock market was full of cheap, good companies.

Looking back now, this was almost a divine intervention. How could Buffett avoid such major crises twice in a row? And why did he remain inactive during the bull market in between? Did he foresee some crisis signals, or did he have insider information unknown to others? Let’s see what Buffett had to say in his shareholder letters from that time.

Back then, Buffett’s shareholder letters were much more valuable compared to now, because he had not yet been deified, and his words were not as pretentious as they are today. Without the internet, these letters were truly just circulated among shareholders. Therefore, Buffett was particularly candid and willing to express his views clearly.

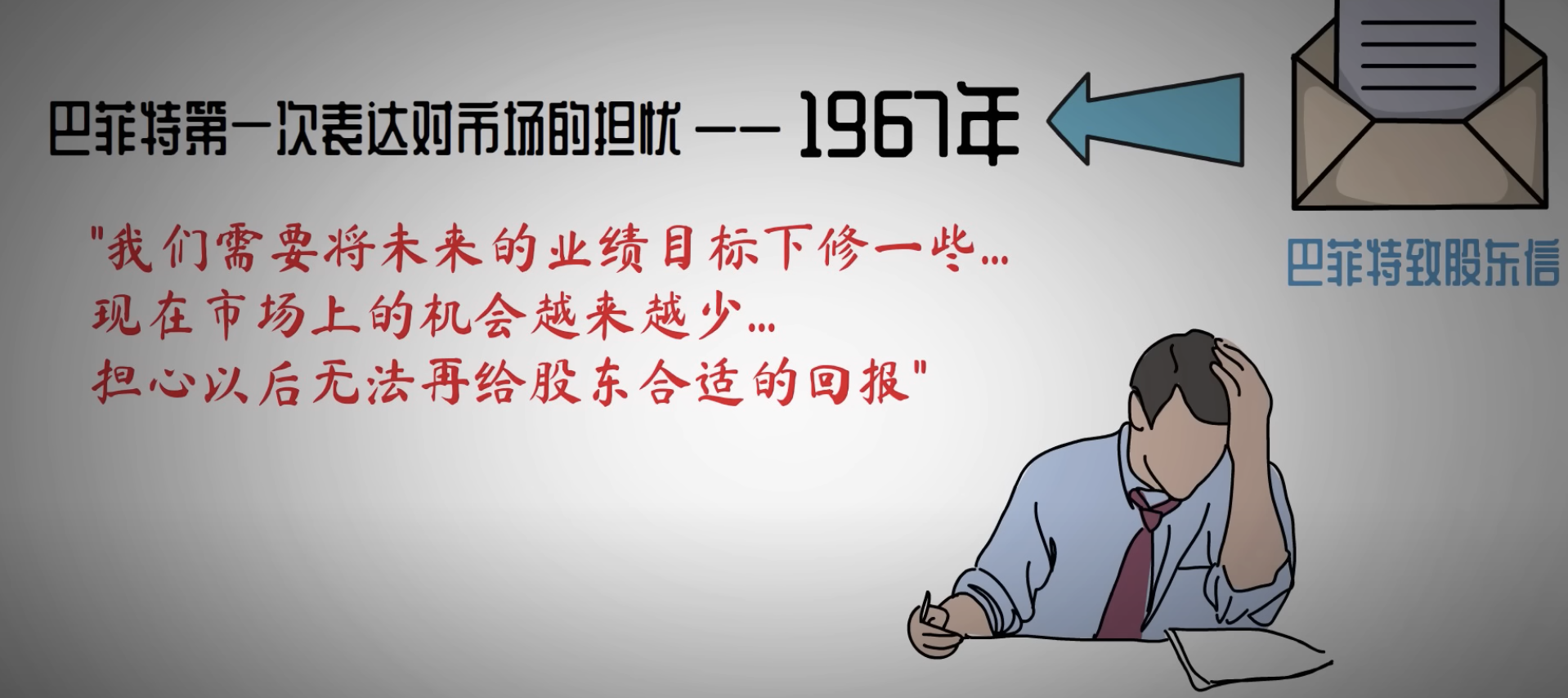

Let’s rewind to 1967, three years before the first stock disaster. At that time, Buffett first expressed his concerns about the market in his letters. He mentioned needing to revise his future business goals downward because he felt opportunities in the market were becoming scarcer. He was worried about not being able to provide appropriate returns to shareholders in the future. It is said that Buffett even considered abandoning investing altogether to pursue other interests. No one believed this at the time, but two years later, Buffett’s actions shocked everyone.

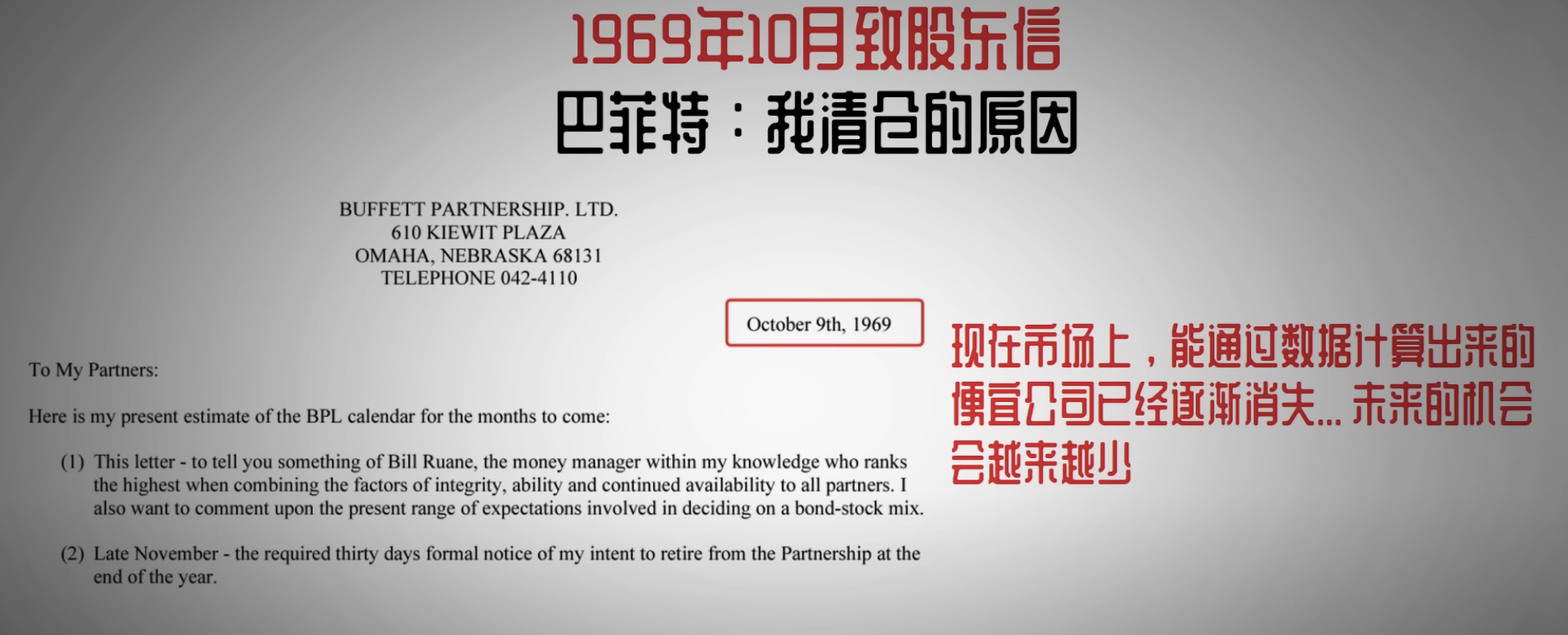

In May 1969, Buffett announced in a shareholder letter that he would completely close his company, Buffett Partnership, and sell all his stocks. At that time, the stock market was still thriving, and Buffett’s move left all shareholders bewildered. In the letter, Buffett explained his decision as follows: he pointed out that the stock market was no longer worth investing in, providing three reasons.

First, from a quantitative perspective, there were no investment opportunities left in the market. Buffett’s quantitative perspective essentially means from a valuation perspective, there were no companies that were both cheap and fundamentally strong.

Second, although the amount of capital had increased, the space for investment had decreased. The large companies in the market were no longer worth investing in, while small companies occasionally had some opportunities, but for their current scale, investments in small companies couldn’t bring enough impact. This means that large companies’ valuations were too high to invest in, while small companies had good opportunities, but the investment amount was too small to make a difference.

Third, Buffett believed that the market had become increasingly speculative. In October of the same year, Buffett wrote another letter to shareholders, further explaining his decision to liquidate all stocks. He said that cheap companies calculated by data were gradually disappearing, and such opportunities would only become scarcer in the future. His main source of profit in investing was to buy cheap companies.

From 1967 onwards, Buffett consistently expressed the same concern in several shareholder letters: expensive. He felt that market valuations were too high, with large companies and good companies both being overvalued. He couldn’t find good investment opportunities, so he decided to stop investing altogether. This explains why Buffett remained inactive even during the market rebound driven by the Nifty Fifty, as the Nifty Fifty stocks were simply too expensive.

Due to various risks affecting the market at that time, such as the dollar decoupling and inflation, investors were very eager for high-quality, safe stocks like the Nifty Fifty. This caused their valuations to become excessively high. For example, McDonald’s, a consumer goods company, had a P/E ratio of 85 times. Similar examples were everywhere. Thus, Buffett’s ability to avoid two major crises and remain inactive during the bull market was not due to any special hidden reasons but simply because the stock market was too expensive at that time.

I know many might still doubt this conclusion. Could such a disruptive action really be due to such a simple reason? You might think there must be some hidden reason behind it. It’s normal to have such doubts. After researching the history of the 1970s, I too had some questions. Let’s look at the next major stock sell-off by Buffett for more insight.

The other classic Buffett sell-off occurred before the 2008 financial crisis. As seen in previous charts, by 2005, Buffett had already accumulated a large cash position, similar to today’s proportion. In the following years, up until early 2008, Buffett’s cash holdings remained high. In fact, during these years, Buffett’s performance lagged behind the market due to holding too much cash.

Looking back, Buffett’s decision to hold a large amount of cash was very wise. It not only helped him avoid the 2008 crash but also allowed him to have enough capital to invest at the bottom. This was another instance of divine intervention. However, the 2008 crisis was different from the 1970s. While the 1970s oil crisis and dollar decoupling had significant elements of chance, the 2008 financial crisis had more traceable signs.

As a financial expert, did Buffett foresee the financial crisis signals in advance? Let’s see what Buffett had to say.

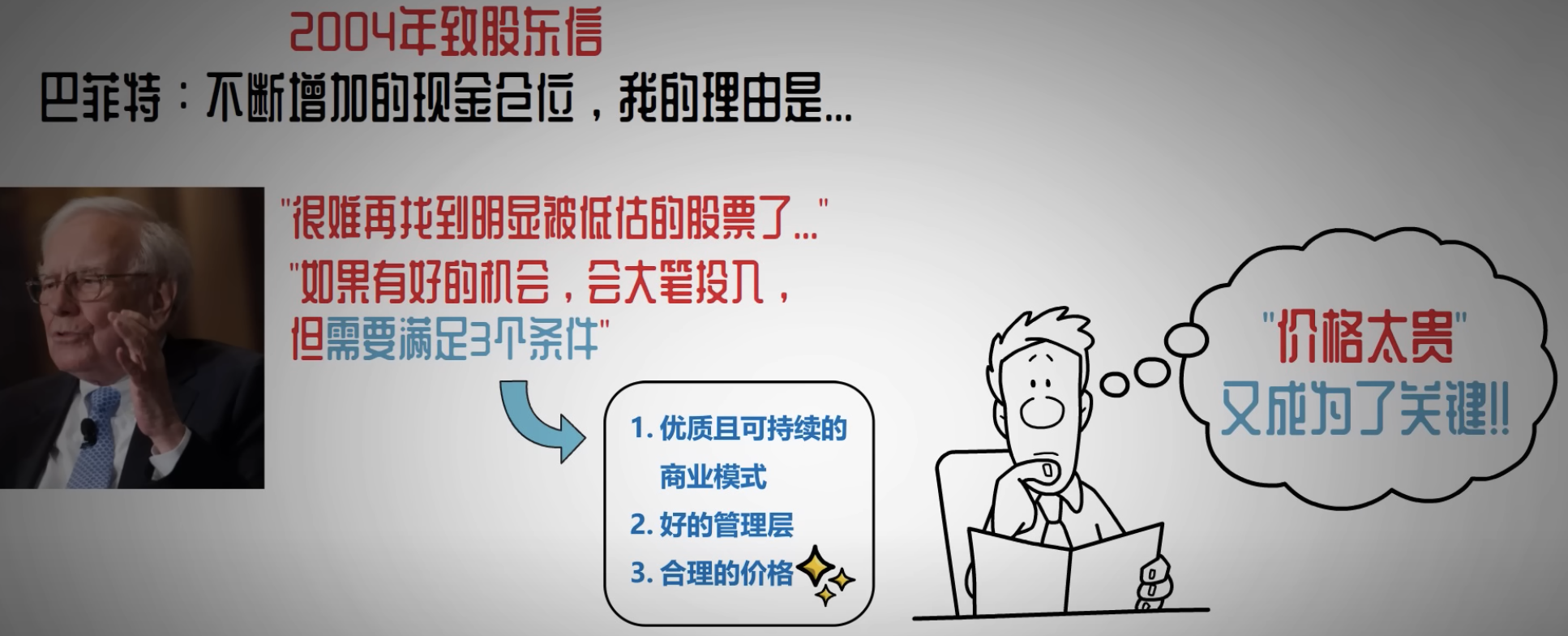

In his 2004 shareholder letter, Buffett explained his increasing cash position by saying that he found it difficult to find clearly undervalued stocks in recent years. Thus, his work also becomes challenging. Buffett also added that if he truly found a good investment and could invest a large sum of money, he would not hesitate. But the precondition is that it must meet three conditions:

First, a high-quality and sustainable business model;

Second, good management;

Third, a reasonable price.

And he still cannot find enough of such companies, so there is no opportunity to spend the cash he holds. Clearly, this time, the high prices once again became the key issue.

Does the macro market risk also account for a certain proportion? In fact, Buffett himself knows that such stock sell-offs inevitably lead shareholders to speculate about the macro environment. He finally explained:

“In any market, under any economic adjustment, I would be very happy to buy companies that meet our standards. As long as the stock price is much cheaper than the value of the company, we will actively buy them. I know our money utilization is not high now; such situations occur cyclically. Although it is painful, it is better than doing something foolish directly.”

It can be seen that macro risk is not what Buffett is truly worried about; he only cares about investing in the right companies. In the year after, in 2005, Buffett’s sell-offs reached a peak. At that year’s shareholder meeting, Buffett said: “I wanted to make a few billion-dollar acquisitions last year. I had the money, but I ended up giving up. Where was the problem? Because I simply could not find any attractive stocks to buy.” He then said: “Now there is more money in the market than five years ago, and this money is willing to pay much more than we did when we were successful in the past to buy stocks.”

Buffett’s words in 2005 clearly explained the reason for his sell-offs. In short, the market at that time, driven by large funds, had no cheap opportunities left. He wanted to buy but could not find any suitable stocks. He would rather hold cash than invest in overvalued stocks.

In the following years, Buffett almost always talked about the issue of prices at the annual shareholder meetings, and they consistently maintained a high cash position until after the 2008 financial crisis when they began buying stocks in large amounts.

It can be seen that in 2008, Buffett’s ability to avoid the financial crisis and buy at bargain prices was fundamentally due to his realization years earlier that stocks were too expensive and he was unwilling to hold overvalued stocks. This was similar to the situation in the 1970s. Frankly, the reason for selling stocks may differ from many people’s understanding of value investing.

In traditional value investing concepts, as long as a company’s fundamentals are not problematic, stocks should not be sold casually. However, from the above stories, we seem to see that Buffett often sells stocks because they are too expensive. Is it really the case that being too expensive is the only reason?

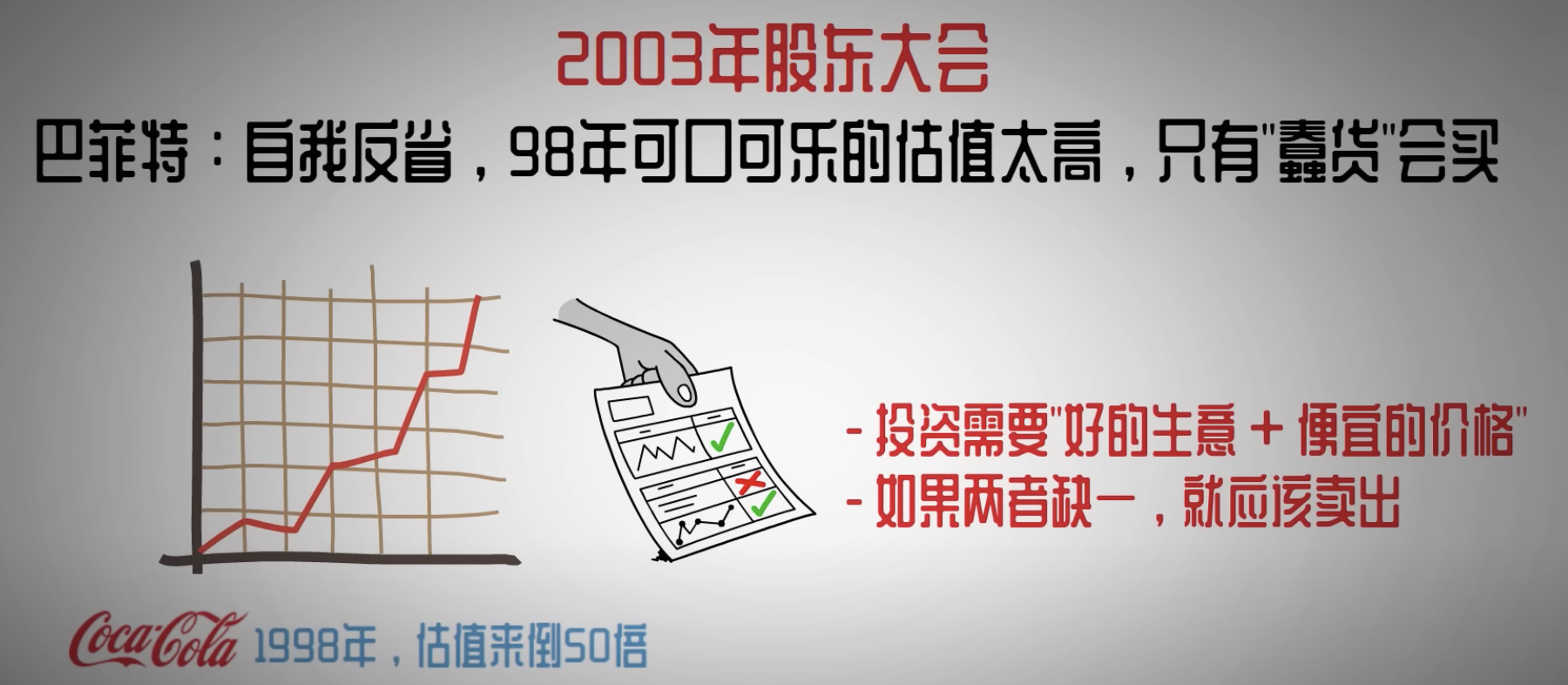

Let me share with you a statement from Buffett. At the 2003 shareholder meeting, he reflected on one of his wrong decisions. He said:

“My holding, Coca-Cola, had a valuation of an astonishing 50 times in 1998. Although it was a very good business, I think those who paid that price for Coca-Cola were certainly impulsive.”

The implication is that Buffett does not believe that a good business is worth investing in indefinitely; a cheap price is also extremely important. Any lack of this should result in selling the stock.

In the 2004 shareholder letter, he mentioned that he considered it a huge mistake not to sell his major holdings in 1998. These companies’ fundamentals are much better now, but the prices back then were much higher than now. He still could not understand why he did not consider selling these stocks at that time. The stocks Buffett referred to here as his mistakes likely include Coca-Cola. In fact, during the recession in 2000, Coca-Cola’s performance was the worst, and its stock price nearly halved at that time.

So, from Buffett’s history of selling stocks and his reflections on stock sell-offs, it can be seen that the core reason for selling stocks is indeed that they are too expensive, with no exceptions. At least on the surface, he expresses it this way. And after years of in-depth research on Buffett, I am inclined to believe that this is indeed his true reason for selling, although behind this reason, there may be deeper thoughts that he has not expressed.

Here, I dare to share some of my thoughts on this with you. There is a saying that high-end ingredients often only need the simplest cooking methods. This is the same for investing; the most sophisticated investment strategies often appear to be plain and unremarkable. Many people see that the stock god can always successfully avoid the peaks, dodge bubbles, and buy at the bottom, and they feel that there must be some unknown reason behind it. But in reality, avoiding expensive stocks is the best solution to achieve all these seemingly impossible things.

Think about it—regardless of whether there is an economic crisis or where there is war or collapse, as long as the stocks you buy are cheap and high-quality, aren’t you not afraid of crises? Moreover, it is interesting that historical patterns show that external crises often come with internal frenzy. As long as you avoid overvalued stocks, no matter what the external crisis is or when it comes, you can naturally avoid it and have enough ammunition to buy at the bottom when the internal sentiment turns to panic.

Therefore, I don’t believe that Buffett can avoid crises every time because he predicts the arrival of major crises. This is merely a wishful interpretation by us ordinary people who cannot do it. Predicting crises is difficult, but maintaining principles is achievable. As long as you consistently avoid overvalued stocks, avoiding crises and having enough capital to buy after a crisis is not an impossible task.

So we see that Buffett always starts selling stocks several years before a crisis hits. The 1970s were like this, and 2008 was too. This is fundamentally because of the reason of being too expensive; it inherently cannot make precise financial adjustments. The market is always irrational; it will cause overvalued stocks to continue rising while undervalued stocks continue to fall. This is human nature, and Buffett does not predict human nature or the market. Instead, he starts from the most fundamental logic, avoids overvalued stocks, and naturally achieves the current effect.

So I see some people say that Buffett is selling stocks now because he sees the risk of a major correction or the potential collapse of the US stock market in the second half of the year. I think these are pure nonsense. I do not know what risks Buffett sees, but I know that he would absolutely not choose to sell stocks because of issues next month or even in the second half of the year. What he truly cares about is the price. People always like conspiracy theories and finding fancy reasons for appearances, but the world is not that complicated; it’s just that those who cannot do it find excuses to explain their own incompetence. In fact, avoiding expensive stocks seems easy but is very difficult to execute.

Many of us have seen that Buffett was able to boldly buy low and ultimately make a fortune during the worst part of the 2008 financial crisis. We think this is difficult, but people seem to forget how stubborn Buffett was before 2008. He held a large amount of cash for four or five years, watched the market rise every day, and saw others constantly questioning him, yet he remained unmoved. This, in my view, is far more difficult than buying at the bottom during a market crash.

And the most fundamental belief behind this is the most ignored and simplest principle: Don’t buy overpriced stocks.

Now let’s return to the current market. I believe Buffett’s selling of Bank of America and more than half of Apple is likely for this reason. Objectively speaking, both Bank of America and Apple are not cheap at present. Will they continue to rise? I think they probably will. Their fundamentals are also problem-free. But perhaps in the view of the stock god, holding stocks with such valuations has reached the level of foolishness.

Should we follow Buffett’s lead and sell the stocks we hold? I don’t know about others, but I know that I do not have Buffett’s patience and courage to hold cash for four or five years and remain inactive while the market rises. But that said, although imitating the great can’t be done, at least we can learn from Buffett’s trading mindset. In the current chaotic and complex market, having such a simple yet enduring investment principle guiding us is, I think, a kind of luck.

Related Content

- Buffett Reveals Ideal Investments if Starting Over at 30

- [Essential Knowledge] Introduction to Options and Low-Risk Strategies

- State of Play in China:Why the CCP Desperately Wants to Reclaim Li Rui's Diary Rights? (Part 2)

- State of Play in China:Why the CCP Desperately Wants to Reclaim Li Rui's Diary Rights? (Part 1)

- Buffett's 1999 Speech:Do the Things That Excite Us